Buy now, pain later? — More can be done to protect BNPL service users

This article is contributed by Melvin Yong, CASE President. Any extracts must be attributed to the author.

Imagine this.

You come across a great deal when shopping.

Your dream pair of shoes is retailing at $299 when it would usually cost $400!

Being low on cash, your eyes are drawn to an advertisement from a Buy Now, Pay Later (BNPL) service, strategically placed to remind you that you can use BNPL to pay approximately $100 per month for the shoes over the next 3 months.

Would you do it?

According to a 2021 report by Mileu, close to a fifth of Singaporeans aged 16 and above have used a BNPL service.

Such short-term financing services are attractive, due to convenience of access and the lack of interest charges. In fact, it has been so attractive that BNPL services are projected to see a 40% compounded annual growth in Singapore, through to 2025.

But as the saying goes — if it’s too good to be true, it probably is. So, what’s the catch?

The Risks Of Buy Now, Pay Later

My worry is that BNPL services may lead to consumers spending beyond their means and make it easy to impulse spend, due to a false perception of increased purchasing power.

This happens in the credit card landscape, and can just as easily happen with the proliferation of BNPL services.

While the Monetary Authority of Singapore (MAS), in a reply to a April 2022 Parliamentary Question, stated that BNPL services currently do not pose significant risks of consumer indebtedness, I believe that we need to do more to shape the nascent BNPL scene.

I am glad to hear that MAS is working with the Singapore FinTech Association (FSA) to come up with a code of conduct for BNPL transactions.

I recently visited SFA and spoke to members of the BNPL Working Group on how consumer safeguards can be strengthened for BNPL schemes, and gave them five suggestions on what the code of conduct for BNPL services should include.

1. Set Limits

Simply put, limits should be set on both consumers and BNPL providers.

Consumers should be allowed to set purchase limits for themselves, to guard against excessive and untenable monthly instalments. There should also be a corresponding limit on the maximum quantum of penalty charges that BNPL providers can levy on consumers, to prevent defaults.

2. Regulate Advertisements

Advertisements for BNPL services should prominently display the total absolute amount that consumers would pay should they default on their instalments.

When deciding to use a BNPL service, consumers may not be aware of non-payment terms such as late fees and accruement of unpayable debt. Such mandatory disclosures will give consumers the full picture of the risks involved in using the BNPL service, thereby preventing reckless spending.

3. Establish Procedures To Assess And Categorise Potential BNPL Users

One of the main criticisms of the Singaporean BNPL scene is that credit is “too accessible”, due to the lack of an assessment of the credit worthiness of its users.

There should be a purchase limit for accounts opened by first time BNPL users and vulnerable accounts, such as people with poor credit ratings and are deemed to be on shaky financial grounds.

These limits can progressively be increased if the consumer is shown to have good credit standing by making timely repayments. In the same light, I also propose a mandatory ceiling (e.g. $500/month) on maximum purchases allowed for users aged below 21, as the vast majority of younger consumers between the ages of 18 and 21 do not earn an income.

4. Integrate Repository Of BNPL-Related Spending Data With Credit Rating

I would like to call for BNPL-related consumer spending data to be included in consumers’ credit ratings, through an integrated BNPL repository that includes both BNPL credit information and credit information from other financial institutions. Consumers should also be made aware of this, in order to maximise the self-regulating effect it has on them.

Consumers can then opt to have a holistic view of their credit standing including BNPL credit status, which will help them gain a better understanding of their financial situation before choosing to use the service.

5. Provide Clear Recourse Avenues For Dispute Resolution

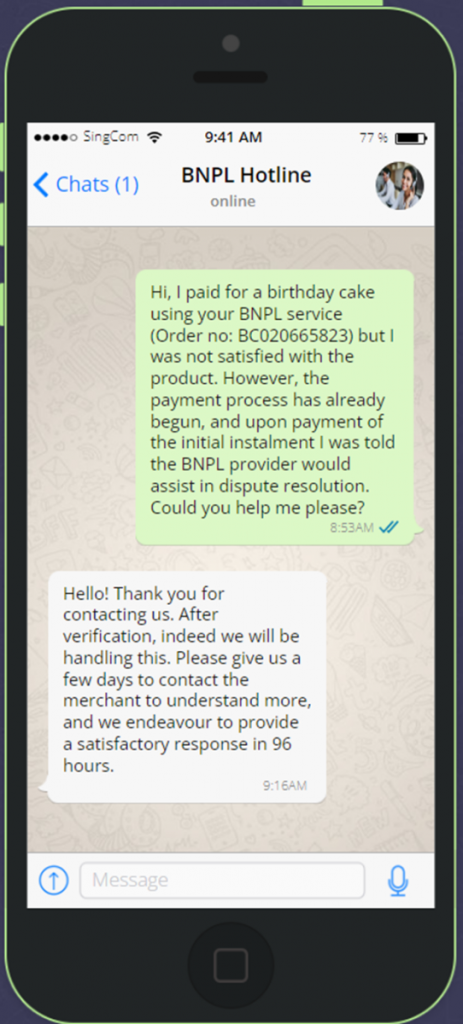

From 1 January 2021 to 23 June 2022, CASE has received 18 consumer complaints involving BNPL service providers. The complaints include technical issues with payments, and inability of consumers to seek refunds. Such disputes are unfortunately inevitable.

Hence, I would like to propose for clear recourse avenues to be made clear to consumers before an agreement takes place. This includes making known to the consumer whether the dispute will be resolved by the service providers or the merchants.

This will help us to transition to a mature Singaporean BNPL scene where consumers can enjoy a seamless and smooth BNPL experience.

What Consumers Can Do

If you are a fan of BNPL services, do keep in mind the following to safeguard yourself:

- Distinguishing needs from wants. Wants have lower priority in being financed and should ideally not be financed for by BNPL services.

- Consciously setting reminders and money every month to pay for instalments.

- Understanding the terms and conditions before stepping into an agreement.

With proper planning, BNPL will be a value-added service to consumers. CASE will continue to work with MAS and the BNPL Working Group to ensure that consumers are protected when using BNPL services, and to ensure that BNPL does not come to mean “Buy Now, Pain Later”.